Sunlight Group: Financial Results for H1 2022

Athens, 25 October 2022

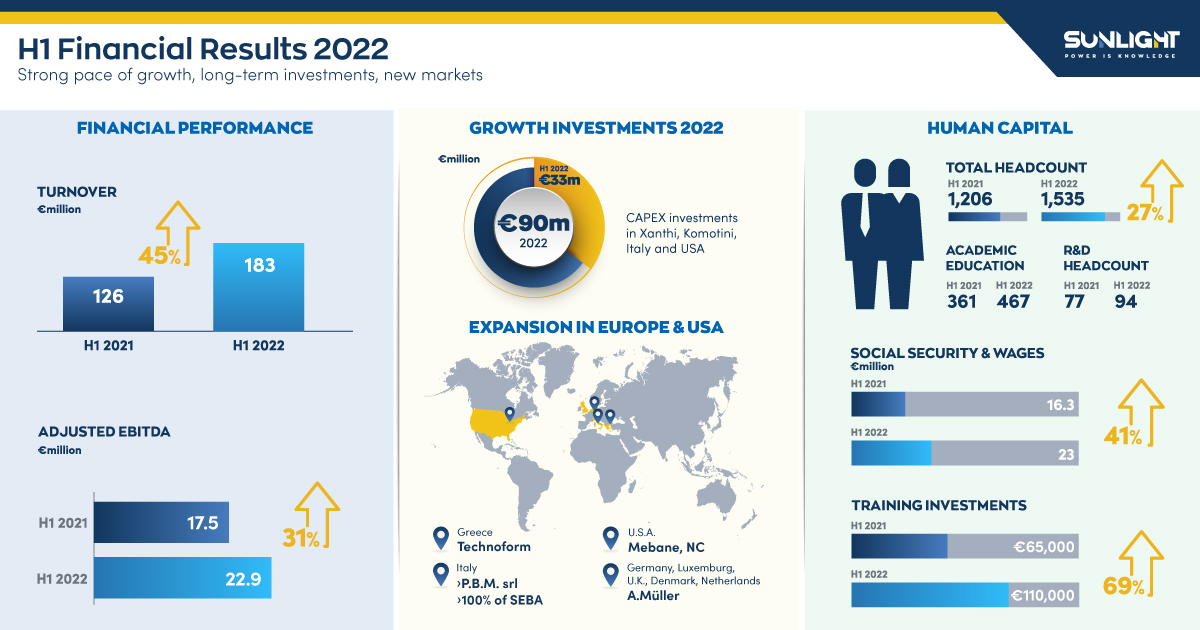

Strong first half, growth investments, new markets

Strong growth trajectory continues

€183mil turnover (VS €126 mil in H1 2021): 45% increase

€22.9mil adjusted EBITDA (VS €17.5mil in H1 2021): 31% increase

Significant investments for long-term growth

€33.5mil CAPEX for H1 2022 and €90mil in total spending by end of year

Increased production capacity, automation, new facilities for lithium assembly and labs, new markets

Investments in human resources

27% increase in workforce

69% increase in spending for trainings

€23mil expenditure for salaries, benefits, and taxes in H1 2022 (VS €16.3mil in H1 2021): 41% increase

Sunlight Group, member of the international investment "Olympia" Group, announces strong financial results for H1 2022 with a 45% increase in turnover and 31% increase in adjusted EBITDA. Recording yet another robust financial performance, despite the challenging environment, the company continues implementing significant investments. €33.5mil have been invested thus far in H1 2022 in CAPEX and €90mil total CAPEX spending are committed by the year end. Sunlight’s diversified and fully funded investment plan focuses on production facilities and infrastructure, advancing both lithium and lead production capacity, as well as major R&D projects on lithium technology.

Achieving high double-digit growth rate in revenue

In the first half of 2022, Sunlight Group continued growing at a double-digit rate with the same trend as of 2021. The company’s turnover for H1 2022 amounted to €183mil compared to €126mil during the same period last year, i.e., a 45% increase. This is attributed to a strong sales performance supported by investments and optimization of Sunlight’s production facilities in Xanthi, Komotini, Verona, Italy and Greensboro, North Carolina (USA). Despite the limitations of the international economy and logistics challenges, Sunlight Group absorbed the pressures via robust growth investments that offer the company a strong advantage and further strengthen its position in the global market. As regards Mergers & Acquisitions, due to the phasing process of relevant agreements only part of the acquisitions was integrated in the financials of H1 2022, while others were either signed very late in the semester or in H2 2022.

Significant hikes in the prices of raw material and transportation, the global shortage of key components like semiconductors, as well as the abrupt increase of energy costs, affected Sunlight’s cost base and, consequently, profitability. To address these challenges, careful measures to recover costs from the market are being applied from the beginning of the year.

Commenting on the release of the H1 2022 financial results, Lampros Bisalas, CEO of Sunlight Group, noted: “In an unstable and complex economic environment affected by intense inflationary pressures, higher interest rates, worldwide lack of resources, constant price increases, substantially higher transportation and energy costs, at Sunlight Group we are making the most of our competitive advantages, focusing on long-term growth investments. One of the key initiatives of this year regards more aggressive investments in the US market and intensified hiring, to better serve our long-term growth plans in USA. Overall, we have retained our strategic course of expanding the company’s product portfolio and customer base, while also expedited planned acquisitions, enhanced the production capacity and automation of our facilities, and expanded our sales network. We are also heavily investing in people, creating new jobs across the organization and attracting highly skilled personnel – both seasoned professionals with excellent qualifications and expertise, as well as younger, eager, and ambitious employees. We accelerate all our investment and expansion plans, despite the current adverse environment, thanks to the support of our BoD, shareholders and customers, as well as our secure funding. We also continue our M&As activity, seek further access to customers and explore upside potential in new products, mainly driven by our desire to play an important role in lithium offerings, both in the industrial mobility and ESS sectors. We firmly believe in our ability to create long term value.”

Fully aware of global challenges, Sunlight remains cautiously optimistic for the second half of 2022 onwards, despite the current macro-economic environment and its potential impact on costs and customers’ ability to order products – due to the recession.

The company continues implementing its diversified strategy, heavily investing in human resources. On 31 June 2022, the company and its subsidiaries employed a total of 1,535 people, 329 more than in 2021 – a 27% increase. It should be noted that the Sunlight workforce is not only expanding, but also becoming more diversified; currently, 27% of employees are located outside of Greece, as the company is continuously expanding its activities in Europe and the US. Furthermore, Sunlight employs a significant number of highly-skilled professionals with over 30% of its workforce being academically trained. Furthermore, a total of €23mil represents company’s expenditure for salaries, benefits and taxes in H1 2022, increased by 41% compared to last year when it stood at €16.3mil. And, lastly, Sunlight Group has greatly increased its spending in employee trainings by 69%, from €65,000 in H1 2021 to €110,000 in H1 2022.

The company is also investing across geographies and plants. This is reflected in the recently announced expansion in the US, as well as the several Mergers & Acquisitions announced in the first half of 2022, including PBM S.R.L. and A. Müller GmbH. These investments aim to enhance Sunlight’s product portfolio, strengthen its presence in international markets, and expand in new ones. In addition, Sunlight Group continues forging a strong supply chain and intensifies its efforts to vertically integrate production, via the acquisition of high-tech components manufacturer Technoform S.A. and investments to more than double the annual production capacity of its lead-acid recycling plant in Komotini. At the same time, investments in R&D aim to foster further innovation and development of “smart” products that contribute to the green energy transition, mainly focusing on lithium technology. These initiatives are anticipated to significantly support the company’s overall production efficiency and deliver on its commitment to a more sustainable ecosystem.